The Asian offshoot of the “bauma” trade show for construction machinery celebrated its debut back in 2002. Thomas took part quite early and participated in November 2020 for the third time as an active exhibitor.

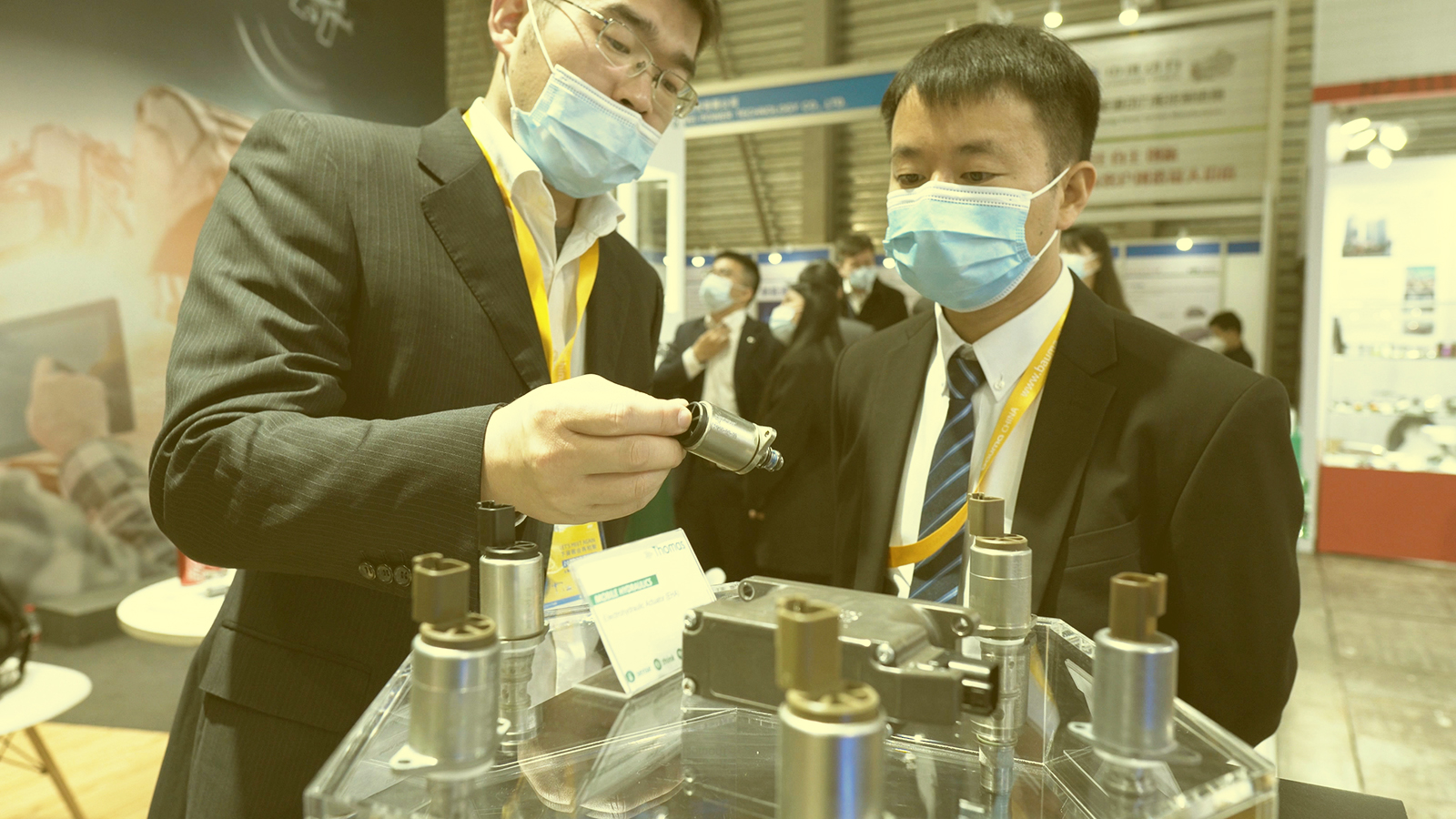

Interest amongst Asian customers for Thomas’s innovative Off Highway products has been growing steadily for many years now. Pilot valves for construction machinery, for instance, are proving very popular and enjoying great demand, while more and more people are becoming aware of the benefits of electrohydraulic systems with added functionality. Asia’s construction machinery industry is gearing itself up for a quantum leap into the future, something that was very clear once again at bauma China in 2020 in late November. The Thomas booth was a resounding success this year, with the EMA electromechanical actuator and other “Sense. Think. Act.” products attracting particular interest from visitors.

Laying the foundations for sustainable growth

It is hardly surprising that Thomas has grown to become an integral part of the trade show – as a supplier to leading brands such as Caterpillar, the company has been regarded as a high-quality provider right from the start. It has also gained a reputation over the years of being an innovative development partner to the Asian market and one that, besides quality, also meets another of its key criteria: fast-paced development. This is what it all comes down to in Asia. Despite what most people might think, Chinese customers have more important priorities than getting production done as cheaply as possible. Asian customers are after the highest possible quality as well as rapid development. Furthermore they are not afraid to take risks and are open to the idea of change. So suppliers like Thomas have to make innovation cycles, samplings and prototyping suitably efficient. Thomas needs to keep up with the fast pace of the market.

Asia, meanwhile, has long since become the most important Off Highway market.

Asia accounts for a third of sales

This would seem to have gone well so far: although the competition in Asia is especially fierce, the Off Highway Solutions unit currently generates nearly a third of its sales from the region. Thomas’s customers traditionally include Western manufacturers and their suppliers with production facilities in China and Japan. Many local manufacturers have also become major customers and are continuing with their systematic process of switching to electrohydraulic solutions. It is therefore already clear that Asia is and will remain the main growth driver for the Off Highway market.

The Chinese market is by far the fastest-growing in the region. And Thomas is participating in this growth, not least because the company decided early on to establish a presence in the country. It has had its own representative office in Shanghai for a number of years. Thomas will be taking the next logical step in 2021 and building its own production facility in China. “To make it crystal clear: it’s not about doing our manufacturing in Asia and then exporting the products to Europe. It’ll only be the markets in the new ASEAN free trade area that we’ll be serving from there. This is the only way we can keep transport routes short and logistics costs down. It’s the only way of ensuring proximity to our customers and responding flexibly to their new requirements. And the only way we can deliver quality and keep up the required pace. Last but not least, of course, the coronavirus has shown us how important it is to become less dependent on international supply chains.”

Flexibility is essential

Once again, the key word is pace. Because it is not only development that happens fast. Customers in Asia also need suppliers who can adapt extremely quickly to changes in demand that kick in at short notice. Whilst using forecasts to plan production and supply in the medium to long term is standard practice in Europe, supply chain managers in China need to be much more agile in responding to customers’ needs. Delivery quantities fluctuate more widely in Asia than in Europe. There are no forecasts. Therefore companies need to be able to react quickly – which isn’t possible when supplying from Germany.

STA products becoming more important

Asia harbors potential for Thomas, in other words, and this potential looks set to grow further. Although the Off Highway segment is about capital goods that take many years to pay for themselves, there are still some discernible trends that will change what products are in demand – and soon.

The signs are pointing towards electrification and automation in the Off Highway sector too. Although the systems are even more expensive and there are many safety aspects that need solving, assistance systems for diggers are just as close around the corner as remote control or even autonomous driving for construction machinery. And, ultimately, no manufacturer will be able to get away with ignoring the positive impact of innovative solutions on the capacity utilization, productivity, work quality, and profitability of the machinery they deploy.

As far as Thomas is concerned, all of this means that the issues of electronics and sensor systems are becoming increasingly important. Thomas effort in the German research project “Bauen 4.0” [“Construction 4.0”] is even attracting attention in Asia, because it involves some hot topics of the future, such as the connected construction site and the real-time integration of construction machinery. With Thomas current STA portfolio, it has managed to lay the initial foundations. Thomas currently got a lot of STA projects under way with Asian customers. Expanding this portfolio is a must if Thomas wants to keep on benefiting from the growth on the Asian market.

No growth without Asia

Challenges remain, of course. For instance, the Asian market for construction and forestry machinery is also susceptible to economic fluctuations. The market might shrink one year and rebound with strong growth the next. All market players live with this risk.